Your cash reserves deserve better than 0%*

Our solutions for businesses

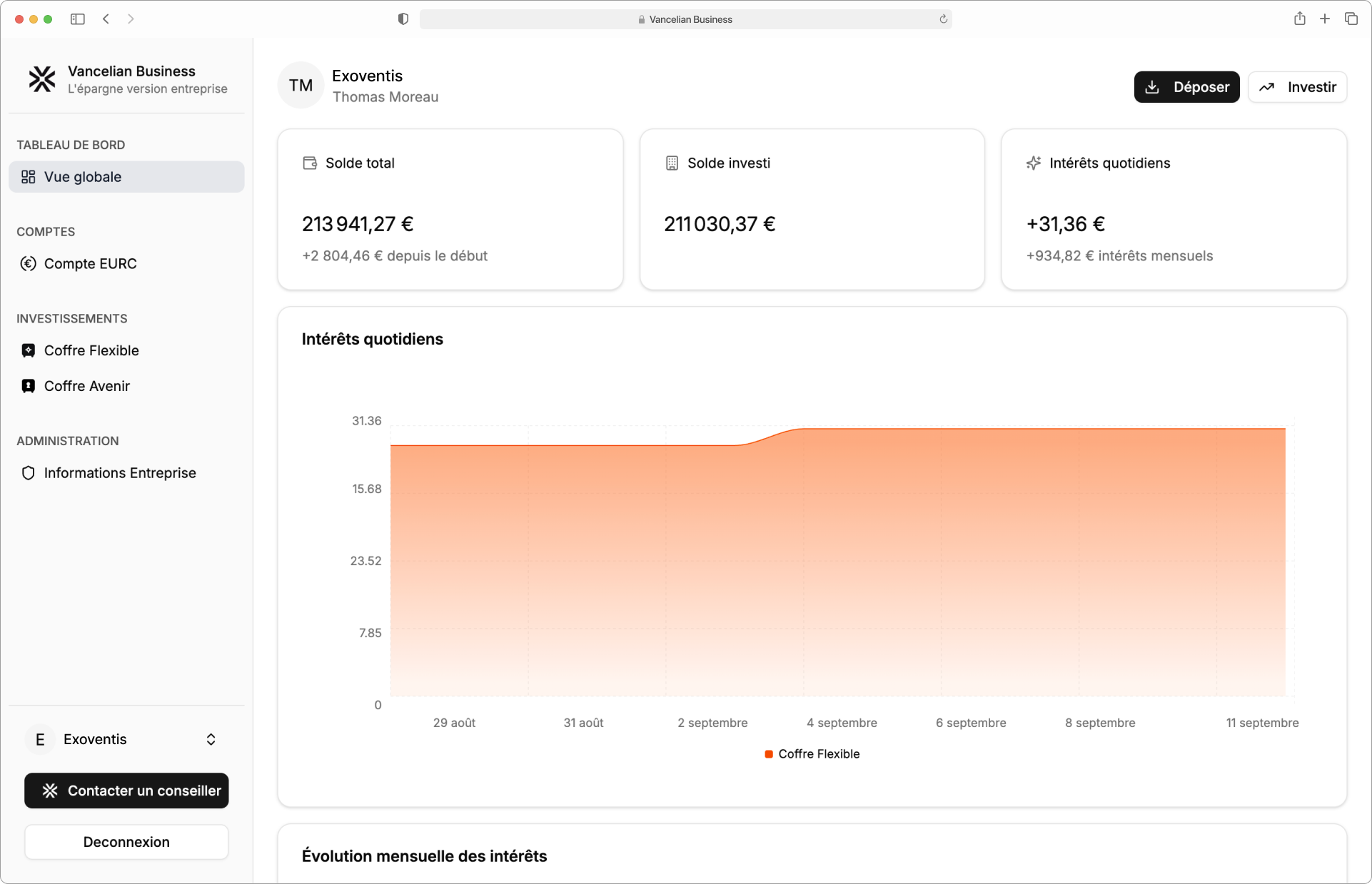

Vancelian Business allows you to transform your excess cash into a performance lever.

Flexible or fixed-term solutions, compliant with European standards, with simple and secure management.

Flexible Vault

A simple solution to enhance your company's excess cash, with full fund availability.

Deposit, withdraw, or reallocate your liquidity at any time, while generating daily compound interest (up to 5% (7)).

Ideal for agile cash management or for building a security reserve immediately available.

Current Rate(7)

5 %

Compound Interest

Yes

Earnings

Daily

Withdrawal

24/7

Deposit & withdrawal

Free of charge

Commitment period

None

Future Vault

A structured placement for companies wishing to plan their excess cash over a medium-term horizon.

Each deposit is locked for 12 months, allowing for a higher return, while benefiting from daily compound interest (up to 7% (7)).

A solution designed to support planned financial projects (future expenses, investments, acquisitions) while optimizing the return/safety balance.

Current Rate(7)

7 %

Compound Interest

Yes

Earnings

Daily

Interests withdrawal

24/7

Deposit & withdrawal

Free of charge

Commitment period

1 year

Exclusives offers

Exceptional investment opportunities, meticulously crafted for ambitious corporate treasuries.

Gain access to hand-picked investment opportunities, carefully selected by our investment committee, across high-growth sectors such as real estate and digital assets.

Driven by a regulated framework and rigorous governance, these offerings combine transparency with sustainable performance, delivering attractive yields distributed daily.

Current Rate(7)

11,1 %

Compound Interest

No

Earnings

Daily

Interests withdrawal

24/7

Deposit & withdrawal

Free of charge

Commitment period

From 18 to 48 months

Strategic Crypto Reserve

Strengthen your company’s financial resilience by diversifying part of your treasury into digital assets.

Our Strategic Reserve allows you to save easily in cryptoassets, within a secure and compliant framework.

A modern solution to anticipate, diversify and prepare your company’s future.

Available allocation

BTC, ETH

Withdrawal

24/7

Deposit & withdrawal

EURC

Diversify your digital assets with our Crypto Baskets

Easily open your basket and diversify your portfolio with direct access to the leading digital assets on the market. Choose between a Top 2 basket (BTC, ETH) or a Top 5 basket (BTC, ETH, SOL, XRP, BNB) and invest in a single click.

Available baskets

Top 2 and Top 5

Withdrawal

24/7

Deposit & withdrawal

EURC

The next-generation savings(1) and investment platform, simple and efficient for businesses

At Vancelian, our mission is to reinvent cash management and investment by embedding them in the finance of tomorrow

Gael Itier, CEO

Our ambition is built on the solid foundations of traditional finance, enriched by the new mechanisms of decentralized finance and blockchain, with the upcoming integration of artificial intelligence to offer truly personalized advice.

With strict compliance and total transparency, we design professional solutions tailored to corporate challenges, within an evolving European regulatory framework.

Key Figures

Behind Vancelian Business, the expertise of a recognized player on the market, with solid experience and tangible results.

450k+

Downloads

100M€

Under management

4M€+

Interest paid