Savings(1) solutions with yields up to 8.3% per year

Our savings solutions are designed to meet users' needs, whether they seek flexibility or a medium-term outlook.

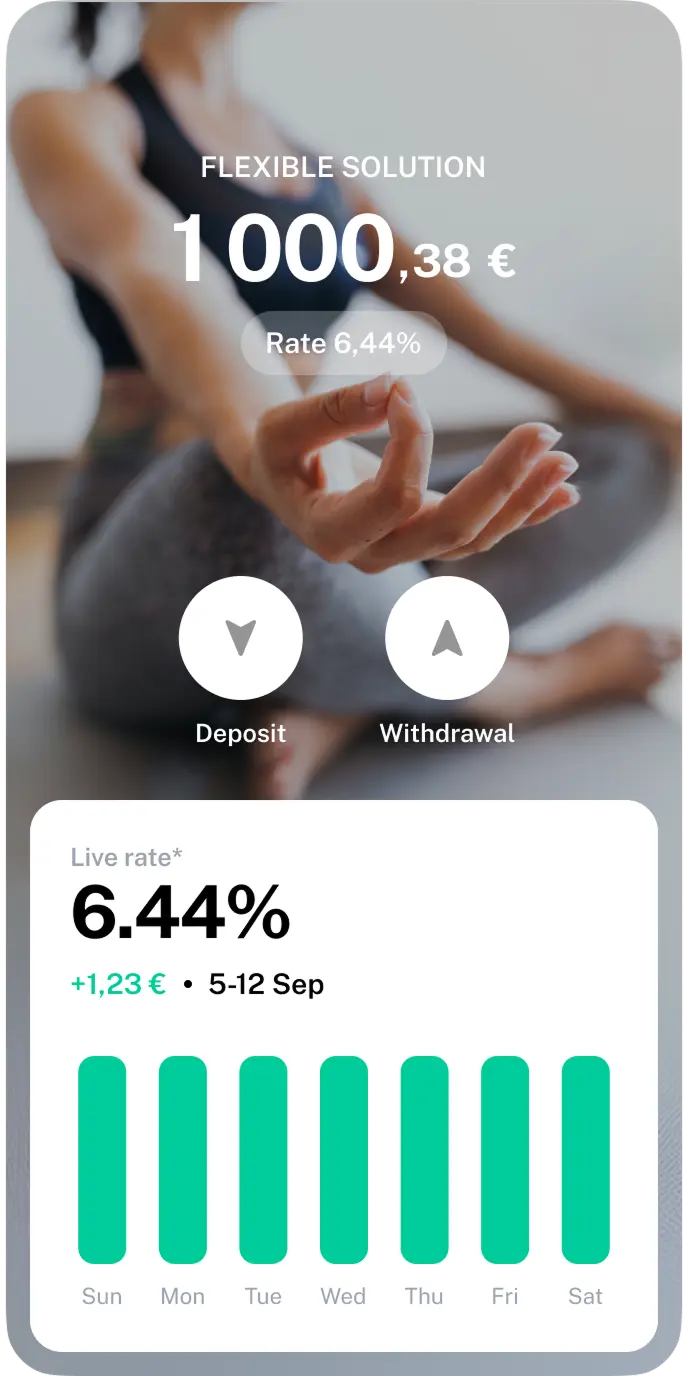

Flexible Savings Vault

An accessible and liquid investment offer, with no commitment period. Deposit and withdraw freely, while generating daily compound interest (up to 6.44%(2)).

Ideal for active cash management or precautionary savings that work continuously.

Current Rate(2)

6,44 %

Compound Interest

Yes

Earnings

Daily

Withdrawal

24/7

Deposit & withdrawal

Free of charge

Commitment period

None

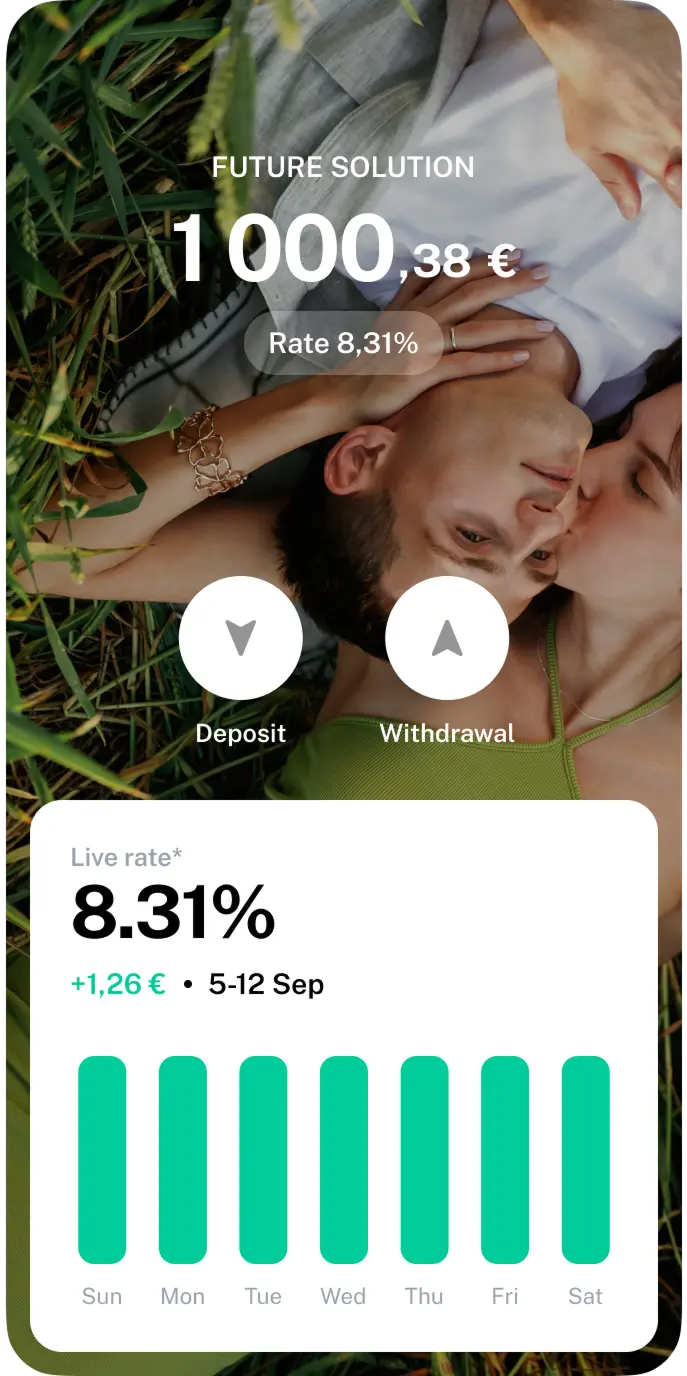

Future Savings Vault

An optimized formula for medium-term projects, with a 12-month commitment and daily yields up to 8.31% per year(2).

The perfect option to support specific financial goals while maintaining an excellent risk/return ratio.

Current Rate(2)

8,31 %

Compound Interest

Yes

Earnings

Daily

Interests withdrawal

24/7

Deposit & withdrawal

Free of charge

Commitment period

1 year