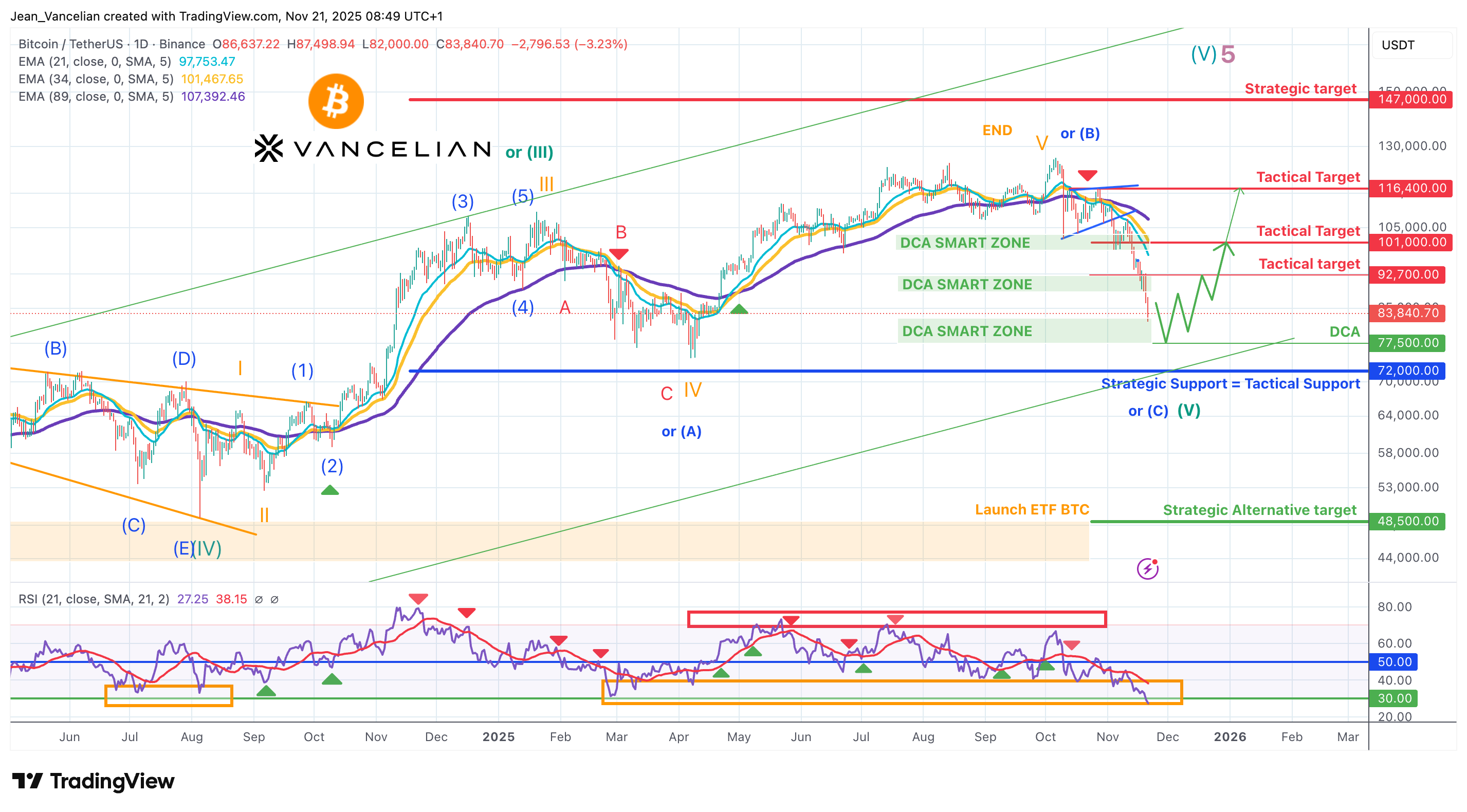

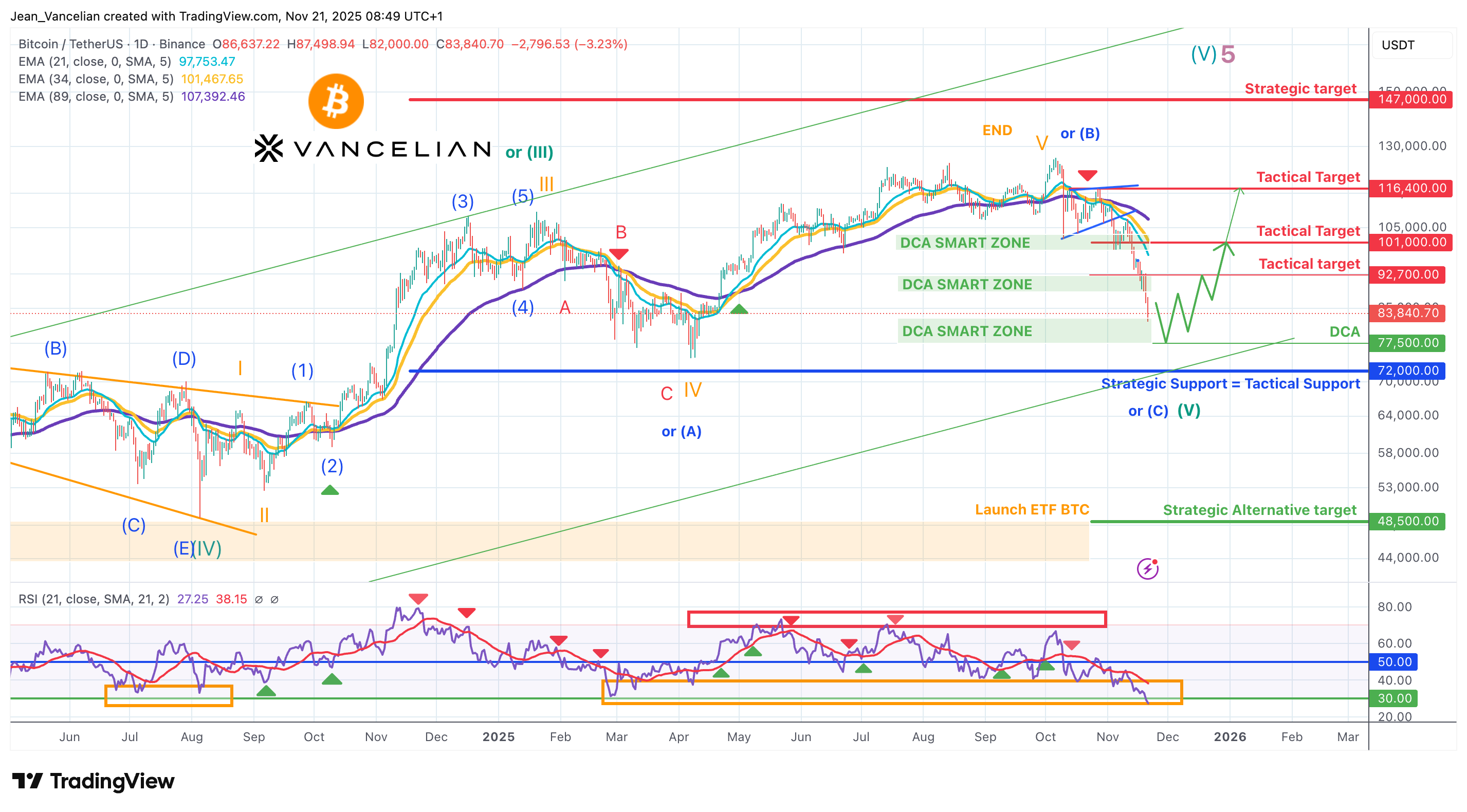

BTC progressing into a deeper consolidation phase – $72,000 remains the key strategic support

Strategic Scenario (6 to 12 months)

Bitcoin has seen a significant shift in momentum since October, followed by a relatively negative month of November. This period has been amplified by the short-term U.S. government shutdown, which has weighed on investor confidence and blurred market visibility.

At the same time, Bitcoin has recently decoupled from gold, while showing increased sensitivity to risk-on assets such as the Nasdaq. This raises questions about the current liquidity profile supporting the crypto market.

Despite this, the long-term structure remains unchanged: $72,000 continues to act as the key strategic support. A rapid recovery above $101,000 would be required to limit a deeper downside risk and confirm the reactivation of bullish momentum.

As long as the $72,000 support level holds, the long-term bullish trend remains intact, with medium-term targets at $140,000 and $147,500.

Key Observation:

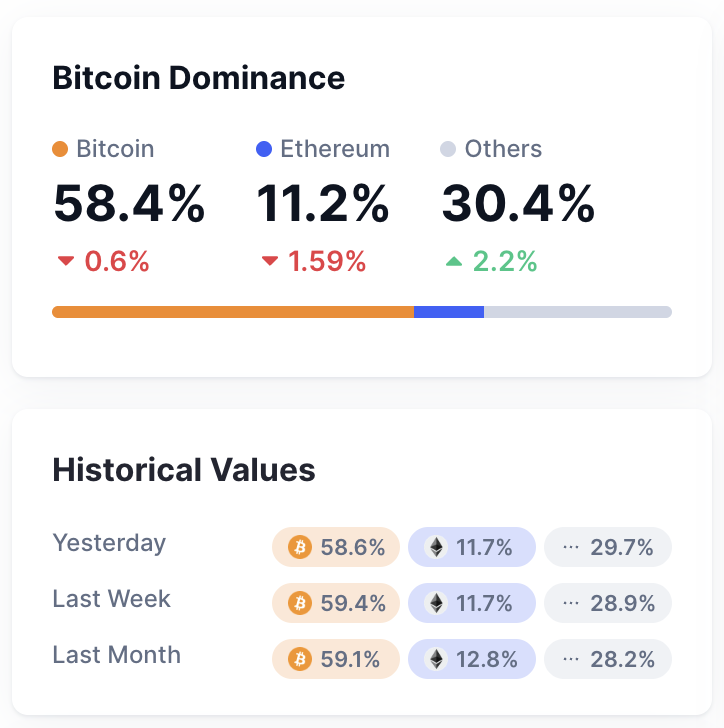

The dominance of Bitcoin has surged to 64% prior to 63,1% in May 2025 (11/07/2025 - source coinmarketcap) of the total crypto market capitalization since November 2024, marking its highest level since 2021. This confirms Bitcoin’s outperformance relative to the broader crypto market, a trend that remains strongly active and further reinforces long-term bullish sentiment. The recent underperformance of BTC can largely be explained by retail-driven portfolio rebalancing, with flows rotating from Bitcoin toward the altcoin segment. This shift has triggered a temporary liquidity setback across the broader crypto market, reinforcing short-term pressure on BTC despite an unchanged long-term structure.

Tactical Scenario in Progress (1 to 3 months)

Bitcoin has failed twice to reactivate the bullish momentum that was initiated earlier in October. The first two DCA zones on the chart illustrate these early accumulation attempts, both of which were absorbed without generating a sustained recovery.

At this stage, all technical signals remain tilted to the downside:

• RSI is firmly in negative territory with no bullish divergence,

• Moving averages have crossed to the downside and continue to accelerate lower,

• The 101,000 $ zone is now acting as a strong dynamic resistance

The Elliott Wave structure presents the two remaining paths. The direct strong bullish scenario has already been invalidated. Current wave counts point toward an irregular Wave IV still in progress, with a completion zone expected between 82,000 and 77,000 $, before a resumption of Wave V on the upside.

Alternatively, a confirmed break below the strategic 72,000 $ support would invalidate the long-term cycle and open the door to a deeper corrective leg, with 48,500 $ as the first key target.

As long as the 72,000 $ strategic and tactical support holds, the last DCA zone is expected to slow the downside pressure and provide conditions for a reversal. In this scenario, the first rebound target stands at 92,700 $, with 101,000 $ as the tactical confirmation level needed to reduce the broader downside risk.

This recovery phase is common to both the larger corrective scenario and the bullish resumption scenario. This means the probability of seeing a rebound between 72,000 and 92,700 $ is elevated, offering an opportunity to improve DCA levels and rebalance portfolios once the recovery is completed in order to materially reduce risk exposure.

Tactical Trade Plan

Buy Strategy: Buy the dip 82,500/77,000$

Targets: $92,700and $101,000 (= rebalancing)

Stop-Loss: Weekly close below $72,000$

Chart: Daily Basis (Candle Stick) - Logarithmic Indicators: Exponential Moving Average (21/34/89) - RSI (21)

Disclaimer: The content of this analysis should not be considered as a study, an investment advice or a recommendation concerning products, strategies or a particular investment opportunity. This content is strictly for illustrative, educational or informational purposes and is subject to change. Investors should not base their investment decision on the content of this site and are strongly recommended to seek independent financial advice for any investment they are considering.