Federal Reserve Meeting – January 28, 2026: Confirmation of a Shift in Macroeconomic Interpretation

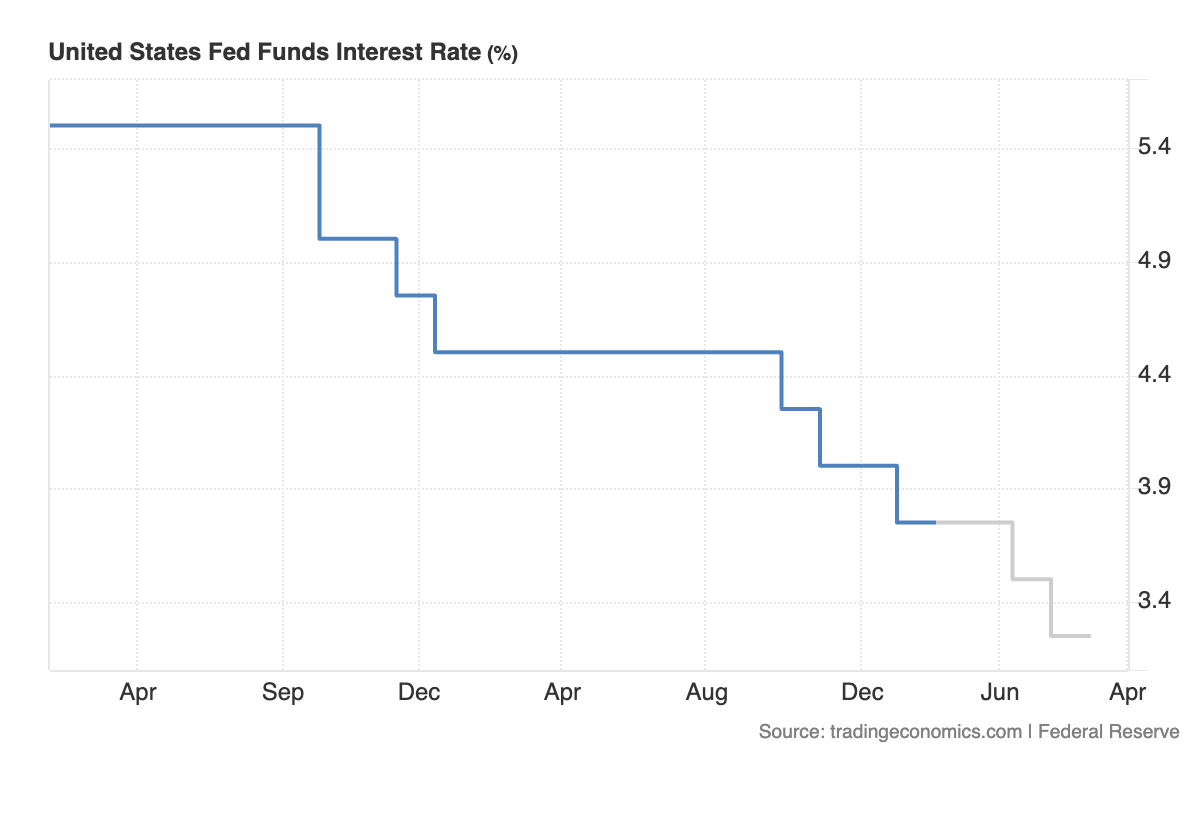

As expected, the Federal Reserve kept its key interest rate unchanged within the 3.50%–3.75% range at its January 28 meeting. This decision marks a deliberate pause in the monetary cycle, following the rate cuts implemented in 2025, with no explicit commitment to further reductions in the short term.

The Fed has now adopted a wait-and-see stance, strictly guided by incoming macroeconomic data. This shift has significantly altered macroeconomic interpretation in recent weeks, illustrated by a pronounced weakening of the U.S. dollar and a continued rise in precious metals, without calling into question the momentum of risk assets, particularly equities. Conversely, this environment weighs heavily on the entire crypto-asset segment, where liquidity has remained severely constrained since the shock of October 10.

U.S. Policy Rate & Forecasts

Key Messages from Jerome Powell (Fed)

Jerome Powell clearly stated that there is no urgency to further reduce interest rates, as the Fed considers the economy to remain sufficiently solid, particularly with respect to the labor market and inflation dynamics.

He emphasized that there is no predefined “test” or threshold that would trigger the next rate cut: decisions will remain strictly data-dependent.

Although inflation has slowed, it remains above the 2% target, justifying a cautious approach.

Finally, Jerome Powell reaffirmed the Fed’s dual mandate—price stability and maximum employment—with labor market conditions remaining the key metric to monitor for any future adjustment of policy rates.

Ongoing Structural Weakness of the U.S. Dollar

The Fed’s decision confirms the scenario anticipated by the market: the end of the U.S. restrictive monetary cycle. The dollar is weakening not in reaction to an immediate rate cut, but because markets now price in the fact that peak rates are behind us.

This dynamic reduces the attractiveness of U.S. real rates, i.e., inflation-adjusted yields. It is notably reflected in the stabilization—or even slight decline—of real yields measured via TIPS, with long-term yields no longer rising.

At the same time, concerns around U.S. debt sustainability and the gradual de-dollarization of sovereign reserves remain central. The persistent rise in long-term yields (10- and 30-year), despite slowing economic growth, reflects less growth expectations than the emergence of a fiscal risk premium, structurally weakening the dollar. This pressure is further reinforced by the trade war initiated by Donald Trump, which forces economic blocs to diversify their reserves, both in currencies and in metals.

Rates: Key Technical Levels

US 10Y: the 4.04%–4.46% zone remains an equilibrium area. A move below 4.04% would signal easing concerns regarding U.S. debt sustainability.

Flow Reallocation: Currencies, Metals, Equities

In this context, investors are reducing their structural exposure to the U.S. dollar in favor of:

other currencies, up between +2% and +25% year-on-year depending on regions,

precious metals, with gold and silver up between +70% and +200% year-on-year,

equity markets, with a relative outperformance premium for non-U.S. equities, which mechanically benefit from a weaker dollar.

This represents a normalization of the dollar following a phase of overvaluation, rather than a monetary collapse. This dynamic must be fully integrated into the analysis of investments not denominated in euros, particularly dollar-based DeFi yields and crypto assets.

With a depreciation of approximately -15% of the dollar against the euro, dollar-denominated returns become mechanically penalizing for European investors, while value destruction in dollar-denominated crypto assets intensifies.

Currencies: Key Technical Levels

EUR/USD: the 1.22–1.28 zone remains critical. In parallel with DXY weakness, the euro continues to strengthen. The central scenario remains a phase of oscillation between the channel breakout base around 1.14 and the upper zone at 1.28. A daily close above 1.28 would constitute a major technical signal.

DXY: target zone located around 95–93.

USD/JPY: the pair is entering a yen-strengthening phase, driven by the stabilization of U.S. long-term yields, the narrowing interest rate differential between the U.S. and Japan, and a gradual return of repatriation flows into Japanese assets.

Bitcoin & Crypto: Lack of Liquidity and Macroeconomic Desynchronization

Within the crypto segment, the lack of liquidity remains pronounced. Bitcoin has failed to crystallize the limited liquidity still available, even though macro correlation projections toward the end of 2025 should have favored an acceleration toward the $140,000 zone alongside gold. The market remains unable to absorb the major liquidity destruction shock that occurred in early October.

Dominant dynamics in currency markets, combined with carry trade hedging strategies, are redirecting substantial liquidity volumes toward FX and rates markets—the only ones capable of absorbing such flows. Bitcoin, in isolation, lacks the depth required to capture these large-scale macro movements.

As a result, BTC is temporarily sidelined, supported mainly by “retail” liquidity that is insufficient to reverse these structural trends. These macro shifts are slow and gradual (comparable to an ocean liner changing course), and a global stabilization phase across rates and currency markets will likely be necessary before a sustainable return of liquidity to Bitcoin can be considered.

Bitcoin: Key Technical Levels

BTC/USDT: the $65,000–$72,000 zone must absorb the liquidity shortfall observed for 2026 to allow a structural trend toward $147,000 to develop. On a tactical basis, $103,000 continues to cap recoveries, favoring range-bound price action pending stronger liquidity inflows into Bitcoin.

Altcoins: Structural Destruction of Value

Bitcoin’s situation should not be conflated with that of altcoins. The valuation trajectories of many tokens structurally tend toward zero, due to uncontrolled and unregulated token issuance inflation. In a context where traditional assets are increasingly moving toward tokenization, purely utility-based tokens risk being durably penalized—or even excluded—from traditional asset allocation frameworks. Observed net liquidity outflows, including through crypto ETFs, confirm this dynamic.

Outside the crypto Top 5—and even then with significant reservations—it is increasingly difficult to anticipate credible long-term appreciation. Conversely, short-term opportunistic trading aimed at exploiting pockets of volatility remains relevant on this segment within a strictly tactical framework.