Interest rate cuts: Towards a new investment cycle

Analysis by Jean Guillou, Chief Investment Officer at Vancelian

22/10/2025

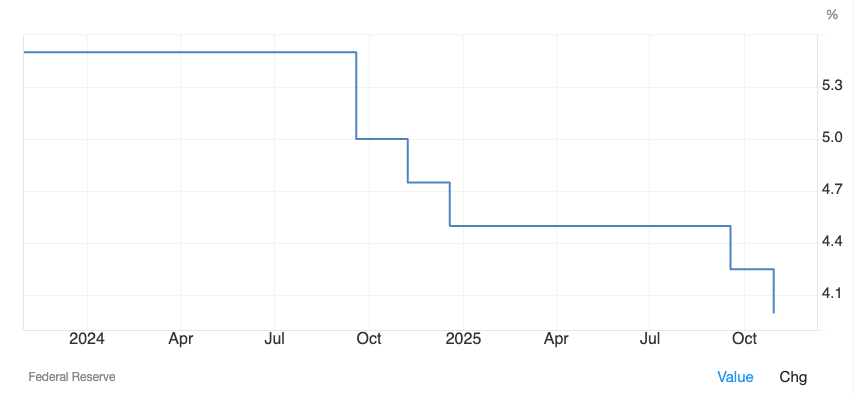

The US Federal Reserve's decision to lower its key interest rate once again by 25 basis points (to a range of 3.75%–4.00%) is in line with the easing trend that began in September, confirming a more accommodative monetary policy stance in the long term.

However, Jerome Powell's measured tone, reminding markets that a further cut in December was ‘not a foregone conclusion’, temporarily dampened market optimism. The Dow Jones, which had briefly exceeded 48,000 points, ultimately closed slightly lower, while the US 10-year yield rebounded to 4.06%, reflecting a reassessment of monetary policy expectations.

However, this short-term reaction in no way calls into question the structural trajectory conducive to the revaluation of assets such as gold, equities and Bitcoin, which continues to establish itself as a strategic benchmark in a long-term portfolio.

The current caution in the markets is more a technical adjustment to optimise DCA or portfolio accumulation at a good price than a change in cycle; the underlying trend remains one of gradual easing, as expected by macroeconomic models, with rates projected at 3.5% in 2026 and 3.25% in 2027.

FED Interest Rate

A trajectory of low interest rates that began in 2025

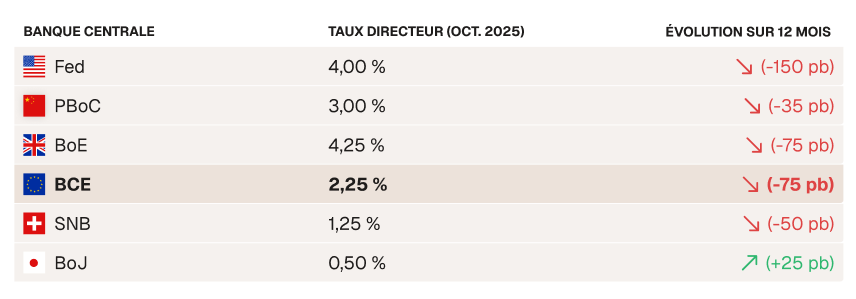

In 2025, the most influential central banks (excluding Japan) will begin a gradual monetary easing, marking the end of a historic post-Covid inflation cycle. This tightening of interest rates will restore liquidity to the markets and stimulate a return of investment, which will be beneficial to the real estate and construction sectors, among others.

At the same time, the ‘deglobalisation’ driven by the Trump administration redefines economic and strategic priorities on a global scale. Capital is being redirected towards sovereign infrastructure (energy, technology, cybersecurity), boosting the technology-oriented equity market (MSCI WIT). Finally, it should be remembered that gold is a reserve asset with no yield, so it is historically inversely correlated with rising interest rates and bond yields. The current fall in interest rates is stimulating a recovery in the price of gold.

Bitcoin (BTC/USD): long-term bullish momentum confirmed – Target $247,000

The strategic outlook remains bullish above $72,000.

Since its historic low of $15,500 in November 2022, Bitcoin has been in a fundamental bullish cycle, driven by two successive halving cycles (2020 and April 2024), with the next one expected in 2028.

Each halving mechanically reinforces the scarcity of the asset, whose total supply is limited to 21 million BTC, thus supporting long-term price growth.

This cycle is illustrated by a trend within a long-term bullish channel, framed by the 55-week exponential moving average, currently around $94,000. This configuration reflects constant buyer interest, fuelled by a macroeconomic context of de-dollarisation and the digital and technological pivot underway in the global financial system.

The adoption of Bitcoin is no longer up for debate. The asset has demonstrated its resilience through previous cycles and now benefits from direct access to institutional liquidity via ETFs and derivatives markets.

At the same time, many companies are pursuing a cash diversification strategy, incorporating BTC into their reserves amid a global currency rebalancing.

Psychological market zones: key cycle benchmarks

Insider zone – $33,400: the end of bear market (2023)

This zone marks the end of the 2022 bear market and the start of a new accumulation cycle, following the collapse of the crypto market caused by the bankruptcies of Terra Luna and FTX.

Since then, a structural divergence has emerged between Bitcoin and the rest of the crypto market: BTC has consolidated its undisputed dominance, while the altcoin segment has never recovered from the destruction of liquidity in 2022.

Ethereum, although less affected, has shown weaker relative performance since its transition to Proof of Stake (PoS), whose structural implications continue to weigh on Bitcoin's trajectory.

Jean Guillou, CIO – Vancelian

« Bitcoin has consolidated a dominant and resilient position, confirming its status as the benchmark asset in the crypto-asset market. »

Followers zone – $72,000: institutional adoption and store of value function

The $72,000 level, the former 2021 high, stands out as a strategic base for the current bullish cycle.

This zone confirms Bitcoin's status as a store of value asset, similar to gold, in a context of de-dollarisation and economic deglobalisation.

It is now referred to as ‘digital gold’, whose volatility reflects the specific nature of the digital asset class.

Since 2022, Bitcoin has posted a performance of +700%, compared with +140% for gold over the same period.

Since May 2022, Bitcoin and gold have been moving in a symmetrical upward trend, fuelled by global geopolitical fragmentation (Ukraine, Middle East, China-Taiwan).

This restructuring has been accompanied by a growing desire to reduce dependence on US Dollar, prompting many states and institutions to diversify their reserves into gold and, more recently, Bitcoin.

The movement has accelerated since April 2025, following Donald Trump's announcements on the strengthening of US customs duties, reinforcing the search for monetary alternatives and safe havens.

Bitcoin & Gold: A convergence of trends

Technical indicators confirm the trend

Bitcoin is currently consolidating around $103,000, supported by a solid chart base between $94,000 and $103,000.

The RSI indicator (21 weeks) is hovering around 50% after purging the previous bearish divergence, paving the way for positive momentum, potentially up to 85%.

The 55-week moving average continues to act as dynamic long-term support, as long as weekly closes remain above it.

Summary

Bitcoin remains in a sustained bullish expansion phase, supported by global macroeconomic dynamics and converging technical signals.

- On a strategic horizon (12/36 months): The key support level of £72,000, the former historic high of 2021, acts as a pivot point for the current bullish cycle, ensuring positive long-term sentiment. A close above £147,000 will be the key signal for the next phase of acceleration in the bullish cycle, with potential towards £195,000 and then £247,000 by 2027.

- On a tactical horizon (end of 2025): the accumulation zone between £94,000 and £103,000 remains an attractive entry point for long-term positions or portfolio adjustments. This zone was already visited during the flash crash on Friday 10 October 2025.

Jean Guillou, CIO – Vancelian

« Bitcoin is now established itself as an alternative and complementary monetary instrument within a rapidly changing global financial system. »