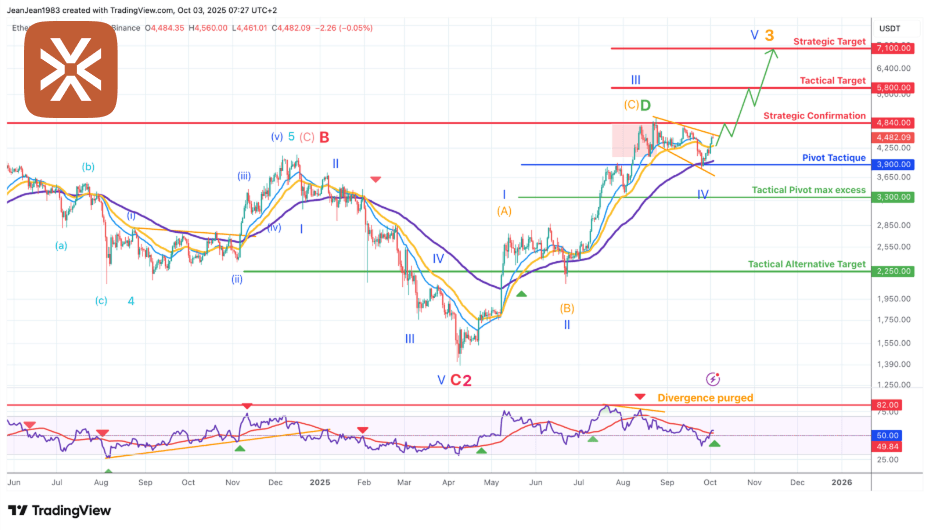

Ethereum (ETH/USDC) Major strategic signal a head with $4,840 Breakout in focus and Tactical Upside Toward $5,800 and $7,100

Date of Analysis: October 3, 2025

Chart Timeframe: 1D (Daily)

Strategic Horizon Analysis (6 to 12 months)

Ethereum remains firmly within its Strategic Bullish Trend, confirmed by the break above the long-term consolidation channel. The Elliott Wave count suggests ETH is progressing into Wave V of Cycle 3, with strategic confirmation at $4,840.

The bullish structure points to strategic targets at $5,800 and $7,100, aligning with the higher red resistance zones shown on the chart. This confirms Ethereum’s potential to outperform in the coming months as it extends its Wave 3 rally.

The Strategic DCA Zone sits between $3,300 and $2,250, offering strong long-term accumulation opportunities if corrective pullbacks occur.

Tactical Horizon Analysis (1 to 3 months)

ETH is currently trading around $4,480 withina bullish pennant pattern, in progress to confirm a tactical and strategic continuation.

Above $4,840 confirmation level, Ethereum should accelerate toward $5,800 as the primary tactical target, paving the way for the strategic move toward $7,100.

As long as Key support stand valid at 3900 a direct upside move is expected

Alternative Tactical Scenario

If Ethereum fails to hold above the Pivot Tactique at $3,900 or breaks below $3,300, bearish pressure could push prices back to Deeper corrections toward $1,650 (major tactical support). It would only emerge in a high-risk scenario, currently considered low probability given the Elliott Wave count.

Technical Analysis Summary

RSI: Neutral at 50%, with bearish divergence cleared, allowing fresh bullish momentum to build.

Moving Averages (21, 34, 89 EMA): Bullish alignment, favoring further upside.

Key Levels:

Strategic Confirmation: $4,840

Tactical Target: $5,800

Strategic Target: $7,100

Tactical Supports: $3,900and $3,300

Alternative Tactical Support: $2,900

Elliott Wave: ETH progressing into Wave V of Cycle 3, confirming a larger bullish continuation phase.

ETH vs. BTC Allocation Context

While Bitcoin dominance remains elevated at 65% (July 2025), ETH has shown relative outperformance since Summer 2025. This supports the tactical thesis of rotating exposure into top Layer-1 majors, particularly ETH, which is now entering a confirmed breakout phase.

Portfolio-wise, tactical overweight ETH relative to BTC appears justified.

Tactical Trade Recommendations

Buy Strategy

Enter long positions above $4,840, targeting $5,800 initially.

Extension target: $7,100.

Suggested Stop-Loss: Below $3,900 (daily close).

Summary

Ethereum has entered a decisive breakout phase, with $4,840 as the strategic confirmation level. Tactical upside points to $5,800, with strategic continuation toward $7,100. Invalidation only occurs below $3,500, with the $2,900–$1,650 zone acting as the corrective alternative.

Chart: Daily Basis (Candle Stick) - Logarithmic

Indicators: Exponential Moving average (21/34/89) - RSI (21)

Disclaimer: The content of this analysis should not be considered as a study, an investment advice or a recommendation concerning products, strategies or a particular investment opportunity. This content is strictly for illustrative, educational or informational purposes and is subject to change. Investors should not base their investment decision on the content of this site and are strongly recommended to seek independent financial advice for any investment they are considering.