Join the Vancelian Privilege Club

Simply open an account and invest. Every euro or crypto-asset you invest brings you closer to a higher level and new privileges.

At Vancelian, our mission is to shift savings and investment into the finance of tomorrow.

But this ambition cannot be achieved without our clients, nor without recognizing their commitment. The Vancelian Privilege Club is much more than a loyalty program: it is a true exclusive club, designed to reward each of your milestones, according to your level of investment in the app.

Access and Levels

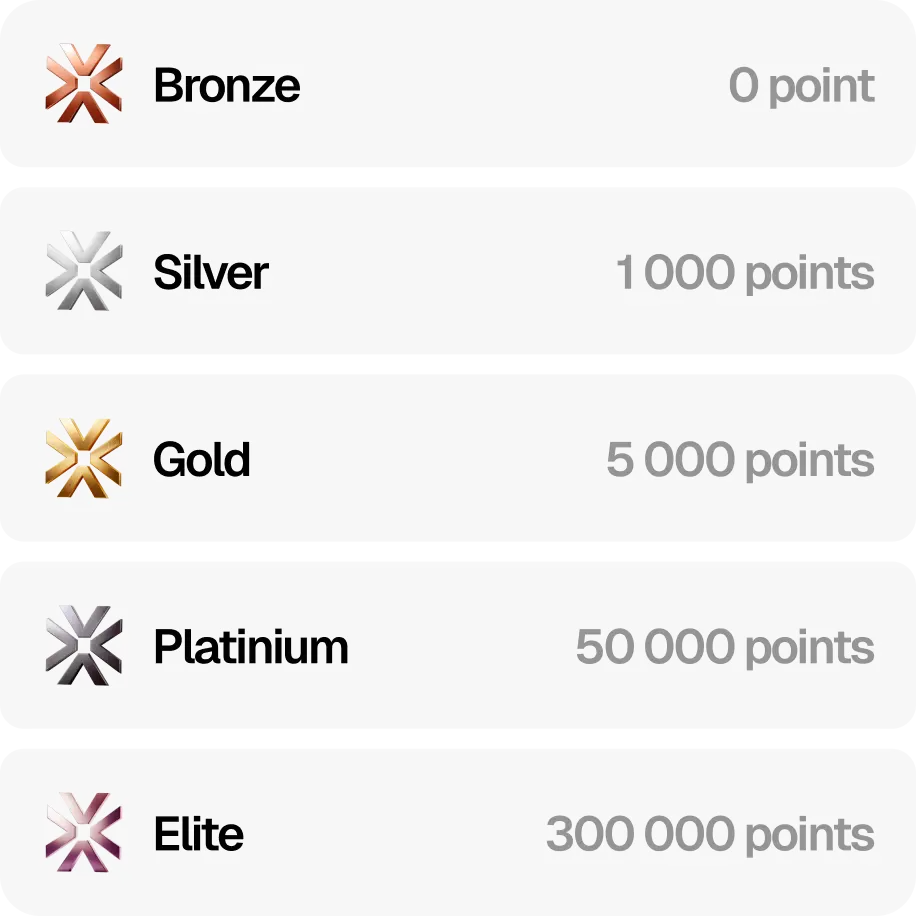

The Privilege Club includes 5 loyalty levels, automatically accessible as soon as you open an account.

You progress automatically by accumulating points in the app through several levers:

1

Investing in Euro or Crypto-assets in Vancelian products

(savings, exclusive offers, crypto-assets, etc.)

2

Buying and holding Vancelian tokens (AKTIO),

especially by locking them for 3 to 12 months

3

Referring new members

4

Performing certain specific actions in the Vancelian app

Actions

Points

Order a PVC card for the first time and activate the card

100 Points

Order a Metal card for the first time and activate the card

200 Points

First deposit by card

100 Points

First deposit via blockchain

100 Points

For each euro deposited in exclusive offers and savings projects

0.3 Points

Holding the token

0.5 Points

Staking AKTIO Coin

Each AKTIO - 4 Points

3 months locking of AKTIO Coin

Each AKTIO - 2 Points

12 months locking of AKTIO Coin

Each AKTIO - 4 Points

If you withdraw funds, or if you sell or unlock Vancelian (AKTIO) tokens, you automatically lose the associated points, which may lead to the loss of your current level (downgrade to a lower level).

What is the Vancelian token (AKTIO)?

AKTIO is the native token of the Vancelian ecosystem. The AKTIO token supports the growth of the platform and gives you access to concrete benefits, designed to enhance the value of your investments.

It supports the platform's growth and is based on a concrete utility: facilitating access to premium services, strengthening user engagement, and creating a bridge between blockchain technologies and next-generation savings.

The key roles of the AKTIO token

Utility token

Once purchased and held in the Vancelian app, AKTIO allows you to accumulate loyalty points giving access to exclusive benefits.

Loyalty accelerator

By locking your AKTIO tokens for a period of 3 to 12 months, you progress more quickly within the Privilege Club and unlock new benefits.

A secure and compliant asset

ERC-20 Standard

AKTIO is an interoperable token, issued on the Ethereum blockchain, ensuring security, transparency, and compatibility with the most recognized wallets.

Free access

You can buy and hold your AKTIO tokens directly via the Vancelian app, or through the Bitmart exchange platform.

Regulatory framework

Issued by AUTOMATA ICO, the AKTIO token operates within a clear regulatory framework, supervised by Irish jurisdiction, and recognized as a utility token.